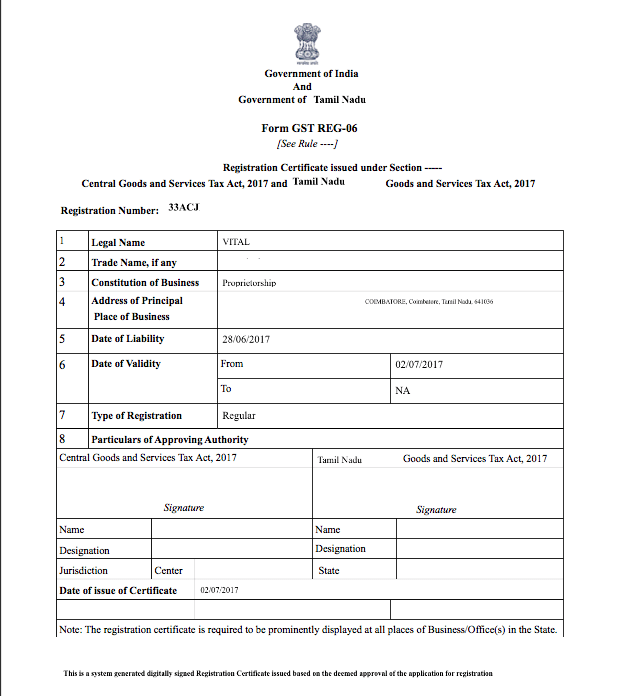

Apply GST Registration Online in India with MyAdvisorr! As per GST legal process, any business operations or any entity with an annual turnover exceeding Rs 40 lakhs must undergo the GST process/procedure in India as a separate taxable provision. As per GST jurisdiction, any business operations whose annual turnover exceeds Rs 40 lakhs must register as a separate taxable provision. This procedure is called GST registration. It takes around 2-6 working days to obtain GST registration online in India.

Start at

Start at

A well-known and over used corporate structure is LLP Registration. LLP and Private Limited corporations are both registered with the Central Government's Ministry of Corporate Affairs. Register your LLP and complete the LLP registration process with MyAdvisor.

One of the most popular types of businesses for entrepreneurs is the limited liability partnership, or LLP. LLPs are the simplest type of business organisation due to the benefit of restricted liability. Limited Liability Partnership registration in India allows partners complete freedom to create a partnership business structure in which each member's or partner's liability is constrained to the amount of capital they contribute to the enterprise. To be clear, if the partnership is terminated in this business structure, creditors or investors cannot demand the partner's personal assets or property or income. MyAuditorr has an efficient team to provide end-to-end service.

Apply GST Registration Online in India with MyAdvisorr! As per GST legal process, any business operations or any entity with an annual turnover exceeding Rs 40 lakhs must undergo the GST process/procedure in India as a separate taxable provision.

As per GST jurisdiction, any business operations whose annual turnover exceeds Rs 40 lakhs must register as a separate taxable provision. This procedure is called GST registration. It takes around 2-6 working days to obtain GST registration online in India.

GST Registration Online in India or Goods and Service Tax - One Nation One Tax

Being the biggest tax reform in India, GST levied on goods and services which includes both the Central taxes (CST, Service Tax, Excise Duty) and State taxes (VAT, Entertainment Tax, Luxury Tax, Octroi). This will help the consumer to bear only GST which is charged by the last dealer in the chain of trade and supply.

As per GST Regime, any business operation whose annual turnover is exceeding more than Rs.40 lakh is needed to register as a normal taxable individual. However, there is an exclusion for hill states and North East, the annual turnover is exceeding more than Rs.20 Lakh for them.

Obtaining GST Registration Online in India is mandatory for all types of businesses whose turnover comes under the above-mentioned criteria. If a business entity carries out any business activities without GST registration, it will be conceived as a punishable offence and the business and its owner will be liable to pay heavy penalties and legal issues.